How Do You Raise Your First VC Round or Set Your Startup Valuation? These Philly Investors Have Some Advice

If you’re a first-time founder looking to raise an institutional round of venture capital for the first time, how do you know where to start?

How does one know how much to raise or where their valuation lies? It’s a position many startup founders will find themselves in within their first few years. It’s also a task every venture capitalist will probably approach differently.

Top of mind right now: We’re still in or maybe soon exiting a period of very high and competitive valuations.

Watch the sizzle

At the start of the year, software startups were fetching valuations at or significantly above 100 times their annualized revenue, PitchBook reported. Compare that to 2021, when median late-stage VC valuation in the US was about 20x revenue, up from 10.9x revenue in 2020.

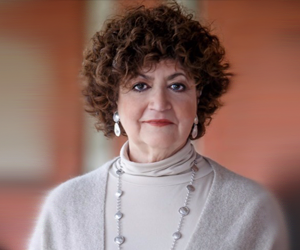

But overvaluations and “following the sizzle” can get companies and their investors in trouble, said Kimberly Klayman, a partner-elect at Ballard Spahr, at a venture capital event hosted by the law firm last week.

If everyone’s standing in line to invest in a company, do you want to get in line?

“I hate chasing hype and trends,” said panelist Brett Topche, cofounder of Red and Blue Ventures. “Do I get caught up? Yes. But we review each deal on its own merit.”

The secret to VC, he said, is that the best venture funds are still wrong a lot of time. He noted a recent study that found a certain fund’s most successful deals were ones that didn’t have full agreement of the partnership when they went in. The smash hit deals weren’t obvious.

Jenn Hartt, the managing director of the healthcare investment group at Ben Franklin Technology Partners, agreed; you can’t make dopamine-based decisions in investing, she said.

“You think you’re going to go all the way to exit on sizzle?” she said. “It’s a scary basis for a decision.”

Read the full article here.