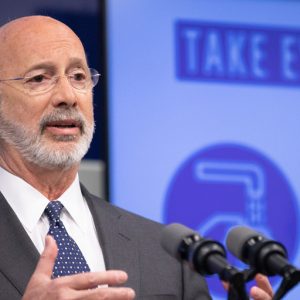

Governor Wolf Requests Disaster Declaration for Small Businesses and Non-Profits to Obtain Loans

Governor Tom Wolf today requested that the U.S. Small Business Administration (SBA) implement an SBA disaster declaration to provide assistance in the form of SBA Economic Injury Disaster Loans for businesses and eligible non-profits in all 67 counties in Pennsylvania.

“The impact of financial losses related to COVID-19 will be felt for years to come,” said Gov. Wolf. “But these low-interest loans can help bridge the gap between economic losses now and economic recovery in the future.”

SBA’s Economic Injury Disaster Loans offer up to $2 million in assistance and can provide vital

economic support to small businesses to help overcome the temporary loss of revenue they are

experiencing. These loans may be used to pay fixed debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact.

The interest rate is 3.75% for small businesses without credit available elsewhere; businesses with credit available elsewhere are not eligible. The interest rate for non-profits is 2.75%.

SBA offers loans with long-term repayments in order to keep payments affordable, up to a maximum of 30 years. Terms are determined on a case-by-case basis, based upon each borrower’s ability to repay.

Read the full article here.